5 Reasons You Need an SWP Return Calculator for Retirement Planning

Planning for retirement comes across as one of the most demanding financial activities in the life of any person. However, besides making investments in mutual funds and other assets as a way of growing one’s retirement corpus, it is also important that one considers how regular income can be generated even after retiring. A Systematic Withdrawal Plan (SWP) will be helpful in this situation. Using an SWP return calculator, you can strategize the most efficient retirement management strategy that guarantees constant returns while protecting the investment.

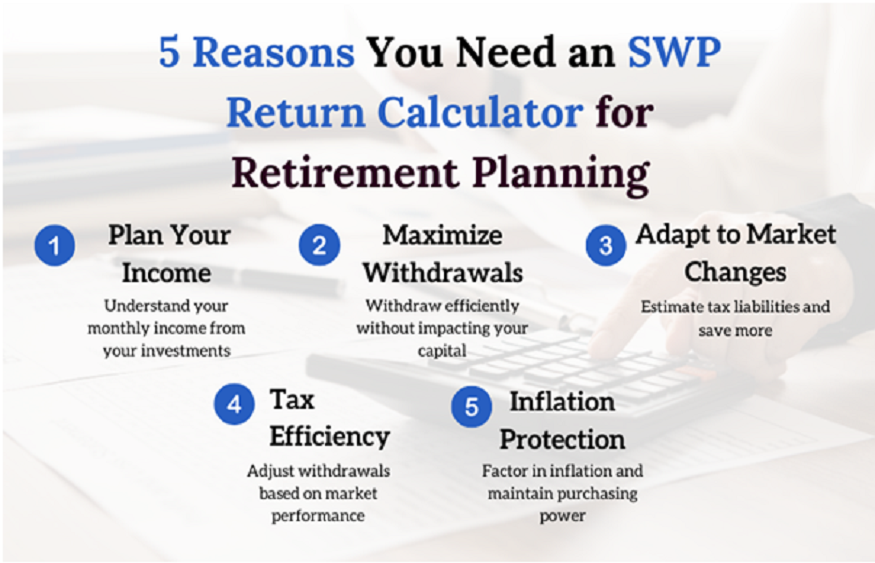

The following are 5 compelling reasons why you need a SWP return calculator for your retirement planning:

1. Ensure Adequate Planning of Your Retirement Income

The first reason for turning to a SWP return calculator is its capability of helping you ascertain how much income from your mutual fund investments you will realize. With an SWP, you are allowed to take out a certain defined amount in equal intervals. But without having access to the actual returns, one finds it challenging to estimate how long his or her investments will cater for regular withdrawals in months or years. It can help you change the presumptions and expectations and calculate different scenarios based on different withdrawal amounts rather than prescribed methods. This makes it easy to ensure you have enough income to last through all your projected retirement years.

2. Utilize Your Investments: Maximize Withdrawals Without Permanent Capital Loss

This is one of the main fears retirees have to deal with, the fear of their capital, for example, being gone in the blink of an eye. The return calculator based on the SWP approach caters to this need. The service got me modeling the rate at which one can withdraw to financially sustain oneself without jeopardizing the possibility of that investment’s growth. From the calculator, a clearer picture of how much it is possible to withdraw while still leaving a good amount of capital is realized.

3. Understand Tax Implications

There is something else that is very helpful about using a SWP return calculator: estimating taxes on withdrawals. Many of the countries consider withdrawals from SWP liable to capital gains tax that depends on whether the withdrawal is from the equity or debt funds and the duration of the investment held. Any decent calculator is enough to show you how much tax money will be taken from you on each withdrawal and further plan your budgets. This is especially useful for … individuals in the higher tax brackets as well as elderly people who require getting maximum value for their money after paying taxes.

4. Adapt to Market Changes

Within a short period, markets can greatly affect your mutual fund return for instance in equity mutual funds. An SWP return calculator helps you to revise your withdrawal mechanism by the market movements. For instance, through the tool, you are given a chance to increase your withdrawals if your investments record high returns. On the other hand, if a market does not perform well, you can limit the withdrawals that are made reducing the drainage on your investment. This flexibility proves beneficial for your retirement plan as it allows the drawing up of contingencies to counter ever-changing market scenarios.

5. Plan for Inflation

Inflation is never a friend to retirement because it will gradually reduce the value of your money as you plan for retirement. An SWP return calculator is also useful because it considers the generally rising rates of inflation and allows you to adapt your withdrawal rates to this circumstance. By entering an expected rate of inflation, you can approximate how much you will need to withdraw in the future to meet your expected lifestyle. This makes the calculator very useful in long time planning for retirement as it can illustrate how your purchasing power will not fade because of inflation.

Conclusion

In conclusion, everyone, who has financial planning for retirement, should use the SWP return calculator. It lets you determine your income strategy, manage withdrawal, consider taxes, flex with the markets, and inflation. With these benefits, you can promote a happy, relaxed, and financially comfortable retirement span. Whether one is in retirement or has a vision of retiring sometime in the future, a SWP return calculator is useful in assisting one get the most out of the retirement period.